Classify each item as an operating investing or financing activity delves into the intricate world of financial transactions, providing a comprehensive guide to categorizing activities based on their nature and impact. This article will explore the distinct characteristics of operating, investing, and financing activities, empowering readers with the knowledge to accurately classify transactions and gain a deeper understanding of financial statements.

Operating Activities

Operating activities are the primary activities of a company that generate revenue and expenses. These activities are directly related to the company’s core business operations.

Characteristics of Operating Activities

- Involve the production and sale of goods or services

- Generate revenue and expenses

- Are essential for the company’s day-to-day operations

Examples of Operating Activities

- Sale of products or services

- Purchase of inventory

- Payment of salaries and wages

- Rent or lease payments

Investing Activities

Investing activities involve the acquisition and disposal of long-term assets, such as property, plant, and equipment. These activities are intended to generate future cash flows for the company.

Characteristics of Investing Activities

- Involve the purchase or sale of long-term assets

- Are expected to generate future cash flows

- May result in gains or losses on disposal

Examples of Investing Activities, Classify each item as an operating investing or financing activity

- Purchase of equipment

- Sale of investments

- Construction of a new building

- Acquisition of a subsidiary

Financing Activities

Financing activities involve the raising and repayment of funds from external sources, such as debt or equity. These activities are used to finance the company’s operations and investments.

Characteristics of Financing Activities

- Involve the raising or repayment of funds

- May result in changes to the company’s capital structure

- Can affect the company’s financial leverage

Examples of Financing Activities

- Issuance of debt

- Repurchase of stock

- Payment of dividends

- Sale of common stock

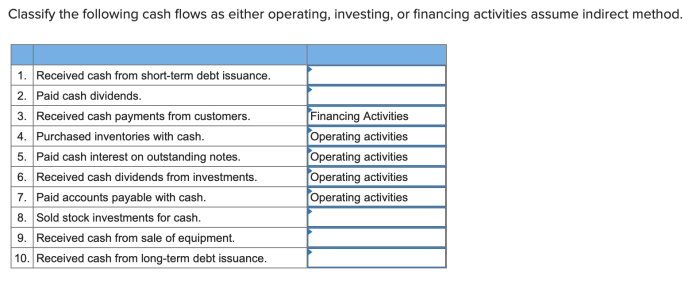

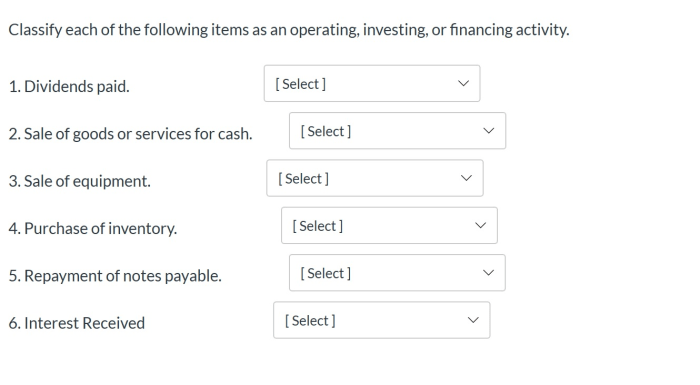

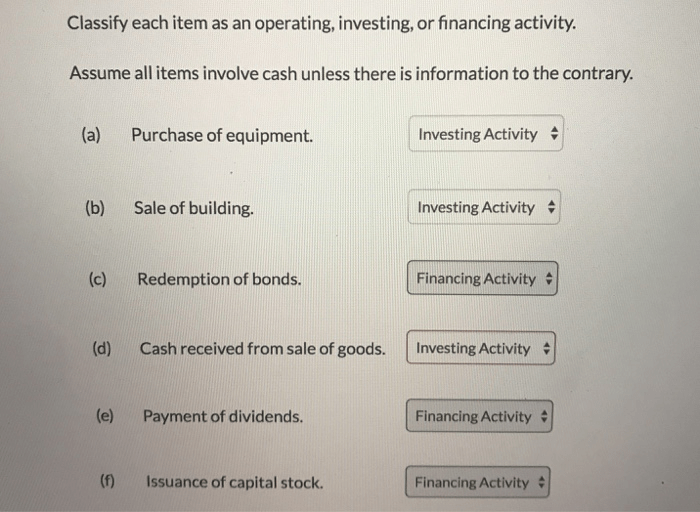

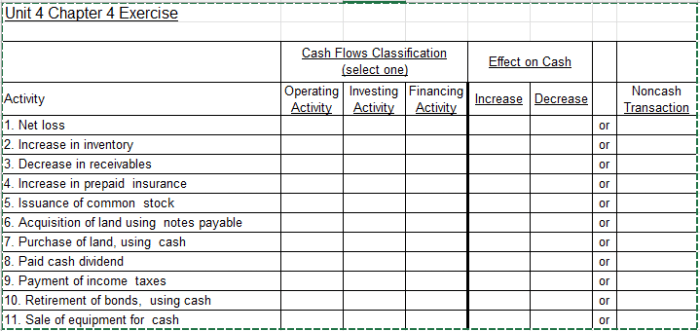

Classify Transactions: Classify Each Item As An Operating Investing Or Financing Activity

| Transaction | Operating | Investing | Financing |

|---|---|---|---|

| Purchase of inventory | Yes | No | No |

| Sale of equipment | No | Yes | No |

| Issuance of bonds | No | No | Yes |

| Payment of salaries | Yes | No | No |

| Repurchase of common stock | No | No | Yes |

| Purchase of land | No | Yes | No |

Q&A

What is the significance of classifying transactions?

Classifying transactions provides insights into the sources and uses of funds, allowing stakeholders to evaluate a company’s financial performance, liquidity, and solvency.

How does transaction classification impact financial analysis?

Accurate transaction classification is essential for financial analysis, as it forms the basis for calculating key financial ratios and metrics used to assess a company’s financial health.